FHFA Attacks Condominium Limited Priority Lien

The condominium “superlien” is under attack. That doesn’t overstate at all the concerted efforts now under way to revoke a measure that has been working well in many states for more than two decades. Nor does it exaggerate the potential threat to the financial health and viability of condo associations all over the country. The Federal Housing Finance Agency (FHFA), primary regulator for the secondary market Government sponsored Enterprises (GSEs), Fannie Mae and Freddie Mac, is spearheading the attack, apparently carrying water for the nation’s largest banks, which have decided they would be much happier if the superlien didn’t exist.Twenty-two states and the District of Columbia have adopted some form of this priority lien, ensuring that condominium associations will be able to collect delinquent assessments ahead of the first mortgage lender. Many of these statutes (including the Massachusetts version) allow associations to foreclose on delinquent owners, if necessary, to enforce their liens.The backlash against the priority lien erupted earlier this year, when courts in Nevada and the District of Columbia ruled that condo association foreclosures extinguished the interests of first mortgage lenders. There was nothing new about this interpretation; this is how superliens have worked since their inception. But the FHFA responded furiously, announcing that:

The Federal Housing Finance Agency (FHFA), primary regulator for the secondary market Government sponsored Enterprises (GSEs), Fannie Mae and Freddie Mac, is spearheading the attack, apparently carrying water for the nation’s largest banks, which have decided they would be much happier if the superlien didn’t exist.Twenty-two states and the District of Columbia have adopted some form of this priority lien, ensuring that condominium associations will be able to collect delinquent assessments ahead of the first mortgage lender. Many of these statutes (including the Massachusetts version) allow associations to foreclose on delinquent owners, if necessary, to enforce their liens.The backlash against the priority lien erupted earlier this year, when courts in Nevada and the District of Columbia ruled that condo association foreclosures extinguished the interests of first mortgage lenders. There was nothing new about this interpretation; this is how superliens have worked since their inception. But the FHFA responded furiously, announcing that:

- The Housing and Economic Recovery Act (HERA), which put Fannie and Freddie into a government-supervised receivership, prevented them from relinquishing the priority position on mortgages they purchased; and

- Vowing to challenge any condo foreclosure that purported to extinguish the GSEs’ priority interest.

A Mysterious ReactionAnyone familiar with the history of the superlien had to be surprised by that reaction. The Uniform Commission on State Laws introduced the six-month priority lien in the Uniform Condominium Act in 1977; the Massachusetts Legislature approved a priority lien in 1993 and some states adopted superlien statutes before that. So it is difficult to understand why the FHFA and many bankers reacted as if they had just discovered that the superlien existed, or only recently understood how it worked. The FHFA’s efforts to scuttle the superlien began in Nevada, but the ripples have spread widely from there, with the challenges playing out mostly in various state and federal courts, as outlined in this brief summary of key developments:

The FHFA’s efforts to scuttle the superlien began in Nevada, but the ripples have spread widely from there, with the challenges playing out mostly in various state and federal courts, as outlined in this brief summary of key developments:

- Making good on its threat to challenge superlien foreclosures, the FHFA has intervened in several Nevada law suits. In three of them, a federal District Court Judge accepted the FHFA”s argument that the federal law (HERA) preempts Nevada’s superlien statute and precludes condo associations from asserting a priority position on mortgages owned by the GSEs.

- A Massachusetts Appeals Court ruled (in Drummer Boy Homes Association, Inc. v. Carolyn Britton) that the state’s superlien statute allows condo associations to have only one six-month lien in place at any time. The plaintiffs (represented by this firm) are appealing that decision, which prohibits the “rolling” or overlapping liens that condo associations in Massachusetts have long used to prevent any gaps in their collection of delinquent payments.

- The Rhode Island Supreme Court recently upheld that state’s superlien statute, rejecting the banking industry argument that although condo associations can foreclose to enforce their lien, the foreclosure does not extinguish the first mortgage lien. While this decision (Twenty Eleven, LLC vs. Botelho) constitutes another victory for the condominium industry, the court granted it grudgingly, expressing concern about the law’s “draconian” impact on lenders. CAI officials have predicted, and I agree, that the FHFA will use the court’s criticism of the superlien to support its argument that the measure is unreasonable and should be revoked.

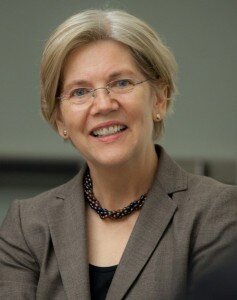

Reaching out to Sen. WarrenSince the FHFA essentially declared war on the superlien earlier this year, the condo industry has been fighting back. In addition to submitting amicus briefs in various court cases, CAI nationally has been lobbying members of Congress in an effort to focus attention on the agency’s actions and the threat they pose to condo associations. In Massachusetts, an ad hoc group of industry executives in which I am involved has initiated a grass roots lobbying effort of its own. We’ve initially targeted Sen Elizabeth Warren, whose reputation as a consumer advocate makes her particularly likely to respond to our superlien concerns. But we’re hoping to enlist support from other members of the Massachusetts Congressional delegation as well.We’ve put together a broadly representative group, including, among others: association managers (Scott Wolf, owner of Greater Boston Properties, Inc. and Laura Cardoos with Barkan Management, Inc.); attorneys (Ellen Shapiro of Goodman, Shapiro & Lombardi and me) and Wesley Blair, senior vice president at Brookline Bank.Although we are all members of CAI-New England, this is not a CAI-NE initiative. Our letter requesting a meeting with Sen. Warren says we are condominium industry professionals involved with thousands of condo associations and condo owners in Massachusetts, who will be harmed if the superlien is eliminated.We haven’t met with Sen. Warren yet, but our request did produce a lengthy phone discussion with one of her senior aides, Bharat Ramamurti, who offered to arrange a conference call with the FHFA’s general counsel, Alfred Pollard. A former Citibank executive (we think that detail is significant), Mr. Pollard has been the agency’s point man on the superlien issue.His initial response to the request that he speak with us was not encouraging. He told Bharat that we had no cause for concern about the FHFA’s position because the Massachusetts superlien statute does not apply to home owner associations. How do you spell “disingenuous,” which in this case, appears to be synonymous with “dishonest?”Because we are not representing CAI-NE or CAI, my response was less diplomatic than it might otherwise have been. Actually, it wasn’t diplomatic at all. I told Bharat that Mr. Pollard’s assessment was “inaccurate and maybe misleading.” While it’s true the state condo statute doesn’t apply to homeowner associations, I pointed out, at least 97 percent of condo communities in Massachusetts are organized as condominium associations, which are covered by the law, rely on the superlien, and have every reason to be concerned about efforts to undercut it.An Unsatisfactory DiscussionThat “detail” clarified, Mr. Pollard agreed to talk to members of our group, but the discussion was far from satisfying: He repeated the FHFA’s argument that HERA precludes a condo priority lien on Fannie and Freddie mortgages and dismissed our suggestion that superlien statues have been working effectively in many states for many years.

In Massachusetts, an ad hoc group of industry executives in which I am involved has initiated a grass roots lobbying effort of its own. We’ve initially targeted Sen Elizabeth Warren, whose reputation as a consumer advocate makes her particularly likely to respond to our superlien concerns. But we’re hoping to enlist support from other members of the Massachusetts Congressional delegation as well.We’ve put together a broadly representative group, including, among others: association managers (Scott Wolf, owner of Greater Boston Properties, Inc. and Laura Cardoos with Barkan Management, Inc.); attorneys (Ellen Shapiro of Goodman, Shapiro & Lombardi and me) and Wesley Blair, senior vice president at Brookline Bank.Although we are all members of CAI-New England, this is not a CAI-NE initiative. Our letter requesting a meeting with Sen. Warren says we are condominium industry professionals involved with thousands of condo associations and condo owners in Massachusetts, who will be harmed if the superlien is eliminated.We haven’t met with Sen. Warren yet, but our request did produce a lengthy phone discussion with one of her senior aides, Bharat Ramamurti, who offered to arrange a conference call with the FHFA’s general counsel, Alfred Pollard. A former Citibank executive (we think that detail is significant), Mr. Pollard has been the agency’s point man on the superlien issue.His initial response to the request that he speak with us was not encouraging. He told Bharat that we had no cause for concern about the FHFA’s position because the Massachusetts superlien statute does not apply to home owner associations. How do you spell “disingenuous,” which in this case, appears to be synonymous with “dishonest?”Because we are not representing CAI-NE or CAI, my response was less diplomatic than it might otherwise have been. Actually, it wasn’t diplomatic at all. I told Bharat that Mr. Pollard’s assessment was “inaccurate and maybe misleading.” While it’s true the state condo statute doesn’t apply to homeowner associations, I pointed out, at least 97 percent of condo communities in Massachusetts are organized as condominium associations, which are covered by the law, rely on the superlien, and have every reason to be concerned about efforts to undercut it.An Unsatisfactory DiscussionThat “detail” clarified, Mr. Pollard agreed to talk to members of our group, but the discussion was far from satisfying: He repeated the FHFA’s argument that HERA precludes a condo priority lien on Fannie and Freddie mortgages and dismissed our suggestion that superlien statues have been working effectively in many states for many years. Mr. Pollard made only one argument that could resonate with Sen. Warren: The FHFA, he said, has a mandate to keep people in their homes, and delaying bank foreclosure actions (which can take some banks as long as 900 days to complete) furthers that goal.Our response: That strategy plays out differently in single-family homes and condominiums. In a single-family home, the lender or loan servicer pays for the insurance and other related expenses a struggling homeowner is unable to cover. In a condominium, the burden of paying a delinquent owner’s fees shifts to other owners, straining their finances and potentially threatening the financial stability of the association.Because Bharat had to leave, and we had no interest in continuing the discussion without him, the call ended abruptly, with no resolution, no meeting of the minds, and no reason to believe the FHFA will be rethinking its position. Bharat has asked our group to draft a memo summarizing our key arguments for why Sen. Warren should intervene in this conflict. We’re working on that memo now, which will emphasize these points:Defending the Superlien

Mr. Pollard made only one argument that could resonate with Sen. Warren: The FHFA, he said, has a mandate to keep people in their homes, and delaying bank foreclosure actions (which can take some banks as long as 900 days to complete) furthers that goal.Our response: That strategy plays out differently in single-family homes and condominiums. In a single-family home, the lender or loan servicer pays for the insurance and other related expenses a struggling homeowner is unable to cover. In a condominium, the burden of paying a delinquent owner’s fees shifts to other owners, straining their finances and potentially threatening the financial stability of the association.Because Bharat had to leave, and we had no interest in continuing the discussion without him, the call ended abruptly, with no resolution, no meeting of the minds, and no reason to believe the FHFA will be rethinking its position. Bharat has asked our group to draft a memo summarizing our key arguments for why Sen. Warren should intervene in this conflict. We’re working on that memo now, which will emphasize these points:Defending the Superlien

- The superlien is an effective and essential tool for condominium associations.

- The problems about which some large lenders are complaining are of their own making for two reasons:

- Many borrowers default because the lender did not properly underwrite the loan to begin with. Condo associations have no role in approving these loans but suffer the consequences of lenders’ mistakes. Other owners, who must pay more to offset the delinquencies, are literally subsidizing those lenders, who:

- Don't make payments they should be making; and

- Benefit unfairly. Because maintenance and essential services are maintained (on the backs of other owners), lenders' collateral is protected, reducing their losses.

- Superlien statutes typically require associations to provide more than adequate advance notice of a pending foreclosure and give lenders multiple opportunities to protect their liens – by paying delinquent fees or initiating foreclosure actions of their own. A bank’s lien is extinguished involuntarily, and only because the bank has failed to take steps to protect its interests, which the Fannie Mae and Freddie Mac servicing manuals specifically require lenders to do. In most cases, the lender attends the foreclosure auction and either bids or allows a third party willing to bid more for the property to purchase it. It’s true this extinguishes the lender’s lien, but the lender receives the amount remaining after the association collects its limited priority amount – a win for the lender, because the association can foreclose more quickly, and a win for the association, because its revenue steam is secure.

- Many borrowers default because the lender did not properly underwrite the loan to begin with. Condo associations have no role in approving these loans but suffer the consequences of lenders’ mistakes. Other owners, who must pay more to offset the delinquencies, are literally subsidizing those lenders, who:

The superlien protects banks as well as condo associations. Associations use the priority lien as both a lever, to prod banks to deal with delinquent owners, and as a collection tool, to protect the revenue stream on which associations rely to pay common expenses and provide essential services to condo owners. Maintaining the property protects the value of the lender’s collateral, which would be impaired if the community falls into disrepair and becomes less desirable to future buyers.

The superlien protects banks as well as condo associations. Associations use the priority lien as both a lever, to prod banks to deal with delinquent owners, and as a collection tool, to protect the revenue stream on which associations rely to pay common expenses and provide essential services to condo owners. Maintaining the property protects the value of the lender’s collateral, which would be impaired if the community falls into disrepair and becomes less desirable to future buyers.- The superlien is not a banking industry issue; it is an issue only for some banks. The presence of a banker (Wes Blair) on our ad hoc group underscores this point. It is the large banks that originated the most flawed loans and experienced the highest foreclosure rates that are challenging the superlien. Smaller community banks, like Brookline Bank, that underwrote loans more responsibly have found that the superlien has worked well for them on the relatively rare foreclosures they have experienced. In fact, because associations can foreclose more quickly, banks sometimes prefer to have them initiate the foreclosure actions.

- It is because of the superlien that condo associations have avoided the worst effects of severe economic downturns, including the most recent one. Revoking the superlien, as the FHFA and some lenders seem intent on doing, would take us back to a time when the inability to collect delinquent fees and maintain association finances devastated condominium communities and condo owners.

One ExampleThere are many examples. David Levy, owner of Sterling Services, Inc., provided this one, from the depths of the early 1990s recession: In a 180 unit community in Framingham, more than 160 owners became delinquent, as owner-occupants fell on hard times and investors walked away. The revenue-starved associations slashed essential services and values declined by 90 percent over a six-year period, with some units eventually selling at auction for less than $5,000. Passage of the superlien statute in 1993 literally saved this community’s life. By the end of 1993, “due mainly to the superlien,” Levy writes, “a sea change had occurred. The banks were paying [back fees] and service levels were beginning to return, which helped increase property values. Those rising property values helped the banks, even those that foreclosed, because they lost less at the auctions…. Teamwork between the banks and condo associations, via the Super Lien law, has created a win-win-win-win outcome for the banks, for the lenders, for Fannie and Freddie, for condo associations and for the vast majority of home owners who pay their condo fees on time,” Levy concludes.We’ll include Levy’s example and his comments in our memo to Sen. Warren, along with our suggestion that there are two ways to resolve the superlien conflict – in a satisfactory way for condominiums.

By the end of 1993, “due mainly to the superlien,” Levy writes, “a sea change had occurred. The banks were paying [back fees] and service levels were beginning to return, which helped increase property values. Those rising property values helped the banks, even those that foreclosed, because they lost less at the auctions…. Teamwork between the banks and condo associations, via the Super Lien law, has created a win-win-win-win outcome for the banks, for the lenders, for Fannie and Freddie, for condo associations and for the vast majority of home owners who pay their condo fees on time,” Levy concludes.We’ll include Levy’s example and his comments in our memo to Sen. Warren, along with our suggestion that there are two ways to resolve the superlien conflict – in a satisfactory way for condominiums.

- Sen. Warren (and other legislators) could simply “instruct” the FHFA to change its position. In the early 1990s, when bad loans were sinking large numbers of financial institutions, the Federal Deposit Insurance Corporation (FDIC) asserted that it had no obligation to pay the fees on foreclosed units owned by failed lenders. Informed about that position, former Massachusetts Congressman Barney Frank told agency officials that they were misinformed – that, in fact, the FDIC was obligated to make those payments, which it proceeded to do. An inquiry from a legislator was all that was required to change the agency’s position.

- Congress could amend HERA to exempt condominium loans from the provision requiring Fannie and Freddie to maintain a priority position on loans they purchase.

Either of these two solutions would work. One of them will be essential to protect the superlien and preserve a system that has worked well and for a very long time for everyone – including the banks that are trying to dismantle it.