LEGAL/LEGISLATIVE UPDATE – DECEMBER 18, 2018

FIX FOR CONSTRUCTION DEFECT SUITS

The Massachusetts House of Representatives has approved legislation that would remove impediments limiting the ability  of condominium association to pursue construction defect claims against developers. Under the existing legal framework, a suit must be filed within three years of when defects are discovered (statute of limitations) or within 6 years after substantial completion of the development (statute of repose), regardless of when the problems are identified. Under that structure, developers can avoid litigation by maintaining control of the community for an extended period, until the deadlines under both statutes have expired. Under the legislation approved by the House, the two statutory clocks would not begin to run until after the developer has transferred control to owners. Lawmakers approved the measure in mid-December, leaving little time for the Senate to vote on it before the legislative session ends December 31. CAI-New England’s Massachusetts Legislative Action Committee, which drafted the measure and lobbied successfully for it, has sent a “call to action” to CAI members, asking them to contact their Senators and Senate President Karen Spilka, urging them to support the legislation. “CAI strongly believes that [the measure] is fair, equitable and a necessary change to the law to protect condominium unit owners,” the letter states.

of condominium association to pursue construction defect claims against developers. Under the existing legal framework, a suit must be filed within three years of when defects are discovered (statute of limitations) or within 6 years after substantial completion of the development (statute of repose), regardless of when the problems are identified. Under that structure, developers can avoid litigation by maintaining control of the community for an extended period, until the deadlines under both statutes have expired. Under the legislation approved by the House, the two statutory clocks would not begin to run until after the developer has transferred control to owners. Lawmakers approved the measure in mid-December, leaving little time for the Senate to vote on it before the legislative session ends December 31. CAI-New England’s Massachusetts Legislative Action Committee, which drafted the measure and lobbied successfully for it, has sent a “call to action” to CAI members, asking them to contact their Senators and Senate President Karen Spilka, urging them to support the legislation. “CAI strongly believes that [the measure] is fair, equitable and a necessary change to the law to protect condominium unit owners,” the letter states.

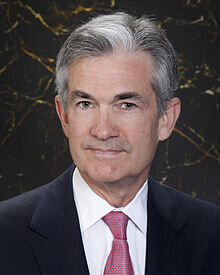

FED RETHINK?

Federal Reserve Chairman Jerome Powell and other Fed officials have been signaling their intention to remain on the rate-tightening course they have been following for the past two years. But an increasingly turbulent stock market and a wobbly housing market may be giving them pause. “We need to be attuned to…the possibility that the U.S. economy could look very different in the first quarter, first half of 2019 than it does now,” Robert Kaplan, president of the Dallas Fed, told the WSJ recently. “There are times when the smartest thing you can do is turn over a few cards and do nothing,” he added.The housing market has been a source of ongoing concern, which the October sales figures did nothing to ease. Existing home sales declined by 5.1 percent in October compared with the same month last year, their largest year-over year decline in four years, “and there is some feeling that the market could actually go even lower,” Lawrence Yun, chief economist for the National Association of Realtors, cautioned.Pending sales for the month declined by 2.6 percent compared with the September index reading, which was revised downward. New home sales, which were expected to rebound from a September dip, fell sharply in October, after the September pace was revised upward. October sales were nearly 12 percent below the year-ago level. Home prices, measured by the Case-Shiller national index, continued to increase, but at a slower pace, “confirm[ing] the slowdown in housing, David Blitzer, managing director and chairman of the index committee at S&P Dow Jones Indices, said in a statement. Separately, Redfin reports that nearly one-third of the homes sold in October sold at prices below their original listings.

Federal Reserve Chairman Jerome Powell and other Fed officials have been signaling their intention to remain on the rate-tightening course they have been following for the past two years. But an increasingly turbulent stock market and a wobbly housing market may be giving them pause. “We need to be attuned to…the possibility that the U.S. economy could look very different in the first quarter, first half of 2019 than it does now,” Robert Kaplan, president of the Dallas Fed, told the WSJ recently. “There are times when the smartest thing you can do is turn over a few cards and do nothing,” he added.The housing market has been a source of ongoing concern, which the October sales figures did nothing to ease. Existing home sales declined by 5.1 percent in October compared with the same month last year, their largest year-over year decline in four years, “and there is some feeling that the market could actually go even lower,” Lawrence Yun, chief economist for the National Association of Realtors, cautioned.Pending sales for the month declined by 2.6 percent compared with the September index reading, which was revised downward. New home sales, which were expected to rebound from a September dip, fell sharply in October, after the September pace was revised upward. October sales were nearly 12 percent below the year-ago level. Home prices, measured by the Case-Shiller national index, continued to increase, but at a slower pace, “confirm[ing] the slowdown in housing, David Blitzer, managing director and chairman of the index committee at S&P Dow Jones Indices, said in a statement. Separately, Redfin reports that nearly one-third of the homes sold in October sold at prices below their original listings.

NO INVENTORY RELIEF

Rising interest rates have taken a large bite out of home sales, but skimpy inventories have been chomping away as well. More new housing is the obvious cure for the market’s inventory woes, but analysts aren’t expecting builders to ramp up production levels much, if at all, next year. “With the construction industry facing significant headwinds from the higher cost of materials and labor as well as rising interest rates, we do not expect much if any growth in new construction starts in 2019 to help alleviate [the inventory shortage],” Trulia notes in its forecast. “And even if inventory begins to pick up in more markets,” the report adds, “it will be rising from multi-year lows and will take a long while to get back to a more balanced level between buyers and sellers.”“Inventory will continue to increase next year, but unless there is a major shift in the economic trajectory, we don’t expect a buyer's market on the horizon within the next five years,” realtor.com Chief Economist Danielle Hale, agrees. Conditions will be particularly difficult for first-time buyers, he predicts, because rising mortgage rates and prices “will keep a lot of the new inventory out of their budget.”Zillow Senior Economist Aaron Terrazas agrees generally with the consensus assessment of prevailing problematic trends but draws a slightly more optimistic conclusion from it. “Certain headwinds – including rising mortgage interest rates, higher rents and stiff competition for housing in the most desirable areas – will only grow stronger over the next year,” he suggests, “but that won’t necessarily be a bad thing. A “slower-moving market,” he believes, will put the brakes on appreciation rates and “give more buyers a chance to catch their breath and choose from a wider selection of homes that fit their preferences and budgets.”

“With the construction industry facing significant headwinds from the higher cost of materials and labor as well as rising interest rates, we do not expect much if any growth in new construction starts in 2019 to help alleviate [the inventory shortage],” Trulia notes in its forecast. “And even if inventory begins to pick up in more markets,” the report adds, “it will be rising from multi-year lows and will take a long while to get back to a more balanced level between buyers and sellers.”“Inventory will continue to increase next year, but unless there is a major shift in the economic trajectory, we don’t expect a buyer's market on the horizon within the next five years,” realtor.com Chief Economist Danielle Hale, agrees. Conditions will be particularly difficult for first-time buyers, he predicts, because rising mortgage rates and prices “will keep a lot of the new inventory out of their budget.”Zillow Senior Economist Aaron Terrazas agrees generally with the consensus assessment of prevailing problematic trends but draws a slightly more optimistic conclusion from it. “Certain headwinds – including rising mortgage interest rates, higher rents and stiff competition for housing in the most desirable areas – will only grow stronger over the next year,” he suggests, “but that won’t necessarily be a bad thing. A “slower-moving market,” he believes, will put the brakes on appreciation rates and “give more buyers a chance to catch their breath and choose from a wider selection of homes that fit their preferences and budgets.”

IF YOU CAN’T RENT THEM – BUILD THEM

As local resistance to short-term single-family vacation rentals builds in many markets, Airbnb, the leading short-term rental platform, is eyeing a new strategy: Constructing homes intended for this purpose. Company officials describe the initiative not as an effort to skirt curbs on rentals of existing homes, but as a means to produce “ideal” vacation rentals, designed specifically for the sharing market.“We began with a simple question. What does a home that is designed and built for sharing actually look and feel like? The answer is not simple at all,” explained Joe Gebbia, Airbnb’s co-founder, who is heading the project, said in a press release. Among the questions his team is addressing: Can a home respond to the needs of many inhabitants over a long period of time? Can it support and reflect the tremendous diversity of human experience?” he continued. “Can it keep up with the rate at which the world changes? Can we accomplish this without filling landfills with needless waste? It’s a tall order.”The Airbnb project, dubbed Samara (which means backyard), will explore how buildings can be designed to “utilize sophisticated manufacturing techniques, smart-home technologies, and vast insight from the Airbnb community to thoughtfully respond to changing owner or occupant needs over time,” Gebbia said.The research will focus on sustainable and environmentally conscious construction. “For us, this goes beyond a business opportunity,” Gebbia added. “It’s a social responsibility.”The company hopes to begin testing prototypes by the fall of 2019.

As local resistance to short-term single-family vacation rentals builds in many markets, Airbnb, the leading short-term rental platform, is eyeing a new strategy: Constructing homes intended for this purpose. Company officials describe the initiative not as an effort to skirt curbs on rentals of existing homes, but as a means to produce “ideal” vacation rentals, designed specifically for the sharing market.“We began with a simple question. What does a home that is designed and built for sharing actually look and feel like? The answer is not simple at all,” explained Joe Gebbia, Airbnb’s co-founder, who is heading the project, said in a press release. Among the questions his team is addressing: Can a home respond to the needs of many inhabitants over a long period of time? Can it support and reflect the tremendous diversity of human experience?” he continued. “Can it keep up with the rate at which the world changes? Can we accomplish this without filling landfills with needless waste? It’s a tall order.”The Airbnb project, dubbed Samara (which means backyard), will explore how buildings can be designed to “utilize sophisticated manufacturing techniques, smart-home technologies, and vast insight from the Airbnb community to thoughtfully respond to changing owner or occupant needs over time,” Gebbia said.The research will focus on sustainable and environmentally conscious construction. “For us, this goes beyond a business opportunity,” Gebbia added. “It’s a social responsibility.”The company hopes to begin testing prototypes by the fall of 2019.

REVERSE MORTGAGE PROBLEMS

Reverse mortgage originations have been declining steadily since the Federal Housing Administration (FHA) tightened lending rules in October. Some reverse mortgage lenders blame the new underwriting rules, but David Stevens, former head of the Mortgage Bankers Association, blames the product. In a scathing Linked In post, Stevens, who served previously as head of the FHA, targeted “outrageous profits,” a “predatory sales approach” and inadequate consumer protections. Program flaws and lending abuses, he said harm both borrowers and the FHA insurance fund, which has taken a beating from losses on its reverse mortgage (HECM) program. Stevens suggested, among other essential changes:

Reverse mortgage originations have been declining steadily since the Federal Housing Administration (FHA) tightened lending rules in October. Some reverse mortgage lenders blame the new underwriting rules, but David Stevens, former head of the Mortgage Bankers Association, blames the product. In a scathing Linked In post, Stevens, who served previously as head of the FHA, targeted “outrageous profits,” a “predatory sales approach” and inadequate consumer protections. Program flaws and lending abuses, he said harm both borrowers and the FHA insurance fund, which has taken a beating from losses on its reverse mortgage (HECM) program. Stevens suggested, among other essential changes:

- Tightening qualifying standards for HECM borrowers to make sure they can afford the taxes and maintenance costs on their properties.

- Barring misleading promotions for the loans. “Seniors do not need aggressive salespeople using former actors and presidential candidates as pitchmen,” Stevens said.

- Limiting the amount of equity borrowers can pull from their homes.

While emphasizing that he thinks reverse mortgages have value, Stevens said the existing product isn’t workable. The solution, he said, is not to continue tweaking it, but to redesign it. Policymakers, he suggested, “should start with what they want form the program and build it from scratch to insure its longevity.”

IN CASE YOU MISSED THIS

What’s in a name change? Approximately $300 million. That’s the estimated cost to the financial industry if the Consumer Financial Protection Bureau changes its name to the Bureau of Financial Protection, as the agency’s acting director, Mick Mulvaney, has proposed.The net worth of U.S. households increased by nearly 2 percent in the third quarter to a near record total of $109.04 trillion.The Department of Housing and Urban Development is awarding $23 million to 80 fair housing groups to help them fight discrimination. Three Massachusetts organizations are on that list. Community Legal Aid, Inc., the Massachusetts Fair Housing Center and SouthCoast Fair Housing will receive $300,000 each.Fannie Mae and Freddie Mac have increased the maximum conforming loan limits for the third consecutive year. The new ceiling on mortgages the secondary market giants will approve will be $485,350 – a 6.9 percent increase over the 2018 limit of $453,100 .The gender gap favors men when it comes to earning power, but women have the edge in homeownership. A lendingTree analysis finds that single women own more homes than single men.

LEGAL BRIEF

OWNER’S BENEFIT ─ ASSOCIATION’S CLAIM

Condominium association boards and owners squabble frequently over whether the association’s master policy should cover damage to an owner’s unit. That wasn’t the issue in this case (Ledet v. FabianMartins Construction, LLC). The master policy clearly covered claims to individual units as well as common areas. The dispute was over an owner’s right to file an individual claim against the policy. Contractors working on a 10th-floor in this high-rise community ruptured a water pipe, damaging most of the units below it, including the unit belonging to the plaintiff (Ledet). The association, the named insured on the policy, submitted a claim for damage to the units and the common areas. Ledet filed a separate claim for damage to his unit, which the insurer rejected, contending that Ledet was not a named insured. Ledet sued, arguing that he was s a third- party beneficiary under the association’s policy, and thus entitled to enforce the association’s rights. The trial court granted summary judgment in favor of the insurers, which Ledet appealed.The key question for the Appeals Court was whether Ledet qualified as a third-party beneficiary. Under Louisiana law, a beneficiary relationship exists if one of three criteria are met:• The beneficiary stipulation is “manifestly clear.”• There is a clear obligation to provide the benefit.• The benefit is “not a mere incident of the contract.”Viewing those arguments as balls thrown by a pitcher, Ledet swung and missed at all of them.

Contractors working on a 10th-floor in this high-rise community ruptured a water pipe, damaging most of the units below it, including the unit belonging to the plaintiff (Ledet). The association, the named insured on the policy, submitted a claim for damage to the units and the common areas. Ledet filed a separate claim for damage to his unit, which the insurer rejected, contending that Ledet was not a named insured. Ledet sued, arguing that he was s a third- party beneficiary under the association’s policy, and thus entitled to enforce the association’s rights. The trial court granted summary judgment in favor of the insurers, which Ledet appealed.The key question for the Appeals Court was whether Ledet qualified as a third-party beneficiary. Under Louisiana law, a beneficiary relationship exists if one of three criteria are met:• The beneficiary stipulation is “manifestly clear.”• There is a clear obligation to provide the benefit.• The benefit is “not a mere incident of the contract.”Viewing those arguments as balls thrown by a pitcher, Ledet swung and missed at all of them.

No Clear Stipulation

On the first point, the trial court found “no manifestly clear stipulation” of coverage for individual owners, and the Appeals Court agreed. Both the policy and the condominium declaration specify that losses are adjusted with the association and that proceeds of any claims are to be paid to the association, the court noted. While the policy gives the insurer the option of settling losses with owners, the court agreed, nothing in the policy “entitles the unit owners to receive direct payment for losses that may include their individual units. Moreover, the court emphasized, the policy’s “unambiguous language” makes it clear that the insurer has no obligation to pay claims directly to the plaintiff. “Even though the policy benefits [Ledet] and other third-party owners by providing coverage for certain types of property that may belong to them,” the court said, “we find that its express language…negates the existence of a[manifestly clear] stipulation, or any enforceable obligation in favor of the individual owners as third-party beneficiaries.” The court similarly found no policy language supporting the second criteria for establishing beneficiary status – a clear obligation on the part of the insurer to cover individual owners. Louisiana’s condominium statute, which requires association’s to provide property coverage for unit owners, also specifies that “they may only recover proceeds under the [master policy] from the Association, not the insurers,” the court noted. And recovery is possible, the court added “only if surplus proceeds remain” after repairs have been made to common areas and covered areas of the units.“This benefit of the insurance proceeds to the unit owners, if any, is an indirect benefit, purely speculative, and is an obligation imposed by the Act upon the Association, not an obligation imposed upon the Insurers under the provisions of the Policy,” the court said. And any benefit claim owners have to a portion of the insurance proceeds paid to the association, the court added, is “insufficient’ to establish a right to demand payment of the proceeds directly from the insurer. “Because no express provision in the Policy exists in the case,” the court said, “we will not read one into it.”

The court similarly found no policy language supporting the second criteria for establishing beneficiary status – a clear obligation on the part of the insurer to cover individual owners. Louisiana’s condominium statute, which requires association’s to provide property coverage for unit owners, also specifies that “they may only recover proceeds under the [master policy] from the Association, not the insurers,” the court noted. And recovery is possible, the court added “only if surplus proceeds remain” after repairs have been made to common areas and covered areas of the units.“This benefit of the insurance proceeds to the unit owners, if any, is an indirect benefit, purely speculative, and is an obligation imposed by the Act upon the Association, not an obligation imposed upon the Insurers under the provisions of the Policy,” the court said. And any benefit claim owners have to a portion of the insurance proceeds paid to the association, the court added, is “insufficient’ to establish a right to demand payment of the proceeds directly from the insurer. “Because no express provision in the Policy exists in the case,” the court said, “we will not read one into it.”

Strike Three

That was strike two. The third strike eliminated a finding that the benefit was direct and not “a mere incident of the contract.” Consideration of the policy as a whole, the court said, indicates that its primary purpose “was not to directly benefit unit owners or to insure their individual units, but rather, was to discharge the Association's obligation under the Act and the Declaration to obtain insurance for the common elements and units against damage and loss, and to protect the Association's interests and property.” Policy language mentioning unit owners, the court contended, did not make them third-party beneficiaries. The benefit Ledet claimed, the court said, “was merely incidental to the primary purpose for which the Insurers and the Association entered into the insurance contract.” Although Ledet “clearly benefits” from coverage under the policy, the court noted, “he is not an intended third-party beneficiary with the right to make direct claims against the Insurers for individual losses; his potential benefits are merely incidental. Put another way, the Insurers did not intend to confer or obligate themselves to provide benefits to individual unit owners directly, nor was making unit owners third party beneficiaries consideration for the insurance contract.”Conferring third party beneficiary status on Ledet would not only be inconsistent with the policy language, the court concluded, it would also have unintended and damaging effects, primary among them: Exposing insurers not only to direct claims by an association under its master policy, but also “to multiple claims by the individual unit owners, non-signatories to the insurance contract, seeking recovery and payment for the same loss.” Equally problematic, the court said, would be the possibility the objection of a single owner could delay a settlement approved by all the others – a result that, the court said, state lawmakers did not intend. “Instead, we find that under the Act, the intention is to have the Association, as trustee for the unit owners, as the only party entitled to receive payment under the Policy for losses or damage to covered property (whether owned by the unit owner or by the Association), so that the Association may then ascertain how and when to distribute those funds, if ever, to unit owners…“Put simply,” the court concluded, “we find the Policy devoid of any benefit flowing directly in favor of individual unit owners, which would create in them a direct right of action against the Insurers to either enforce the Policy or demand its performance.”

WORTH QUOTING

"With an increasingly cloudy economic outlook over the next two years, builders may be growing weary of putting sticks in the ground that won't be delivered to buyers for several months' time ... having only barely recovered from the last downturn, no one is eager to be swept away in the next economic storm brewing just beyond the horizon.” ─Aaron Terrazas, senior economist at Zillow.